Aotearoa/New Zealand: Hipkins is trying to foreclose the notion of transformational change. That's not his decision to make.

Chris Hipkins is a more honest politician than Jacinda Ardern.

Ardern was elected Prime Minister in 2017 on the promise of change, pledging to lead a transformational government that never materialised. She resigned five years later leaving Aotearoa with a significantly more unequal distribution of wealth than when she took power.

Her successor does not pretend to be a transformative leader. Hipkins is honest: he aims to manage the country competently, tinker around the edges, and refuse any notion of radical change. The Prime Minister made concrete his commitment to this bland, managerial style of politics in July when he emphatically ruled out implementing a wealth tax or a capital gains tax under a government he leads.

This comes at a time of hardship for many New Zealanders. Wages were already too low and housing affordability was already at crisis point when the country was hit with an economic triple-whammy: first during the pandemic with the fastest ever increase in wealth inequality; second, the sudden onset of a cost-of-living crisis as inflation soared; and third, the deliberate engineering of a recession by the Reserve Bank, which has cranked up interest rates to the highest levels in 14 years.

Our economic system is broken. Now is the time for the government to take serious action to fix it. That can only happen if those who are hoarding so much wealth at the top of society are made to pay their fair share. A wealth tax is the first step towards building a more equal Aotearoa. More than ever before, it is essential that we tax the rich.

For the Prime Minister to choose this moment to rule out both a wealth tax and a capital gains tax is a disgrace. Labour cannot claim to be the party of the working class while siding so clearly and openly with the wealthy few. Yet the battle to tackle Aotearoa’s social, economic and environmental problems does not end with the Labour leader’s cowardly announcement.

Hipkins is attempting to foreclose the notion of transformational change. That’s not his decision to make.

Why Is Hipkins alienating middle New Zealand?

“With many Kiwi households struggling, now is simply not the time for a big shake-up of our tax system.”

Hipkins’ reasoning for ruling out major tax changes this election cycle is utterly bizarre. It does not remotely make sense.

Many Kiwi households are struggling, that much is true. That is precisely what ministers Robertson and Parker — who are clearly disappointed by this announcement — were planning to address. Revenue minister David Parker unveiled a report in April conducted by Inland Revenue that showed the wealthiest 311 families in this country hold a staggering $85 billion in net wealth between them, and pay an average tax rate of just 9.5% on their income — around a third of the tax rate paid by a typical worker. The already strong case for the government to tax the rich more and ordinary workers less was instantly made urgent and crystal clear by these findings.

Meanwhile, finance minister Grant Robertson asked for advice from the Treasury on policies that would begin to repair our broken and unjust tax system. The policy under consideration would have seen net wealth over $5 million taxed at 1.5% per year. This would only have affected the 25,000 richest individuals in Aotearoa, the top 0.5% of the population. With this money, the government would have made the first $10,000 of annual income tax free for all — a change that would have resulted in a $1000 tax cut every year for 95% of New Zealanders.

This policy was common sense. It would have helped the vast majority of people at the expense of the wealthy few, who can afford to pay more and are not currently paying their fair share.

It wasn’t even a radical policy. Our income tax system would still have been more punitive at the bottom end than Australia, where there is a tax-free threshold on the first $18,200 earned ($19,536 in NZD), or Britain, which has a “personal allowance” of £12,570 ($25,426 in NZD). The wealth tax proposed would have been revenue-neutral, all proceeds going to the corresponding tax cut — it would not have raised the extra money the government desperately needs to spend on fixing the housing crisis, reducing poverty or taking urgent action on the climate. But it would have been a significant step in the right direction.

With many Kiwi households struggling, now is precisely the time for a big shake-up of our tax system. That is blindingly obvious to everyone, with the only exceptions being the wealthy few — and Hipkins, apparently.

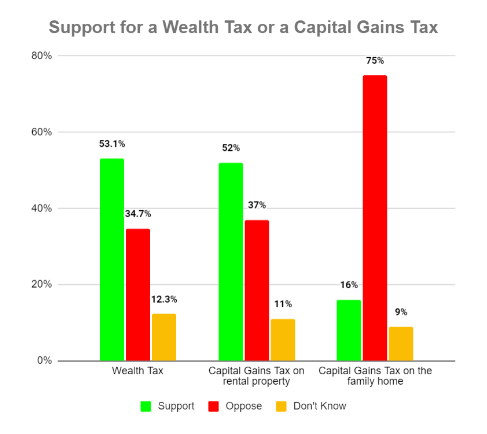

A Newshub-Reid Research poll conducted just prior to the budget in May showed that 60.5% of eligible voters support a wealth tax, while 39.5% are opposed, excluding the 12.3% who answered do not know. A newly released 1 News-Verian poll taken in early July shows that 58.4% support a capital gains tax on rental properties, with 41.6% opposed, excluding 11% who do not know. Support for taxing rental capital gains is higher among Labour supporters. 82.4% would be opposed to a capital gains tax on the family home, because it would affect ordinary people struggling to get by. The evidence shows that “middle New Zealand” wants to tax the rich.

Grant Robertson, the second most powerful member of the government, was clearly in favour of a wealth tax, as were David Parker and presumably multiple other ministers and Labour MPs — not to mention the party’s own members and supporters. So why on earth did Hipkins rule it out?

It is not true to claim, as Bernard Hickey does, that the reason this tax switch has been shot down is because it does not appeal to the “median voter”. The median voter is part of the 60.5% who support a wealth tax, and the median voter would directly benefit from a wealth tax and a tax free threshold. People are not stupid, they can see that this policy is in their interests. At every debate, Labour could have slammed National and ACT’s tax cuts for the rich while saying loud and clear: we will give ordinary Kiwis a tax cut, and we will make the rich finally pay their fair share. It would have benefitted Labour’s election campaign immensely, and neutralised the central plank of National and ACT’s appeal to voters.

This move also hurts Labour’s chances of forming amicable coalition deals with the Green Party and Te Pāti Māori. Both parties have responded defiantly to Hipkins’ announcement, as both are campaigning for higher taxes on the rich. This will in turn hurt Labour in the campaign and strengthen National’s attack line that a Labour-led Government will be a “coalition of chaos”.

The Greens’ tax policy is similar to the tax switch Grant Robertson was considering, as it also includes a wealth tax and a $10,000 tax-free threshold — though the wealth tax is tougher and that tougher tax along with other tax increases on the top 1% of New Zealanders would fund a bold plan to guarantee a minimum income to everyone and end poverty in this country. The party’s co-leader James Shaw made it clear in a press conference that what policies are on the table in coalition negotiations is up to the voters, not the prime minister, urging everyone who wants a fairer tax system to vote Green and threatening Labour with the prospect of the Greens sitting on the cross benches and holding the government over a barrel on every single policy if they have the numbers to do so. This marks a change in Shaw’s approach, given his previous friendliness with Labour governments, having served as climate minister since 2017.

Te Pāti Māori have come out swinging even more stridently, with co-leader Debbie Ngarewa-Packer calling Chris Hipkins “arrogant” for attempting to rule out policies championed by TPM and the Greens, and stating that Hipkins may have ended coalition negotiations before they even began. Te Pāti Māori’s tax policy is even more ambitious than the Greens’ — TPM want to eliminate GST on kai, introduce a $30,000 tax-free threshold, and implement a variety of wealth taxes to do so, including a top tax rate of 8% on all net wealth over $10 million.

But perhaps the biggest issue caused by Hipkins’ refusal to tax the rich is that a third term Labour government will have no money to enact genuine change. The reforms implemented during Ardern’s tenure, which were inadequate and not transformational but nonetheless meaningful, were possible due to a strong economy in 2017-2019, followed by a swift recovery from the Covid crash in 2020. But that is not going to be the case in the next three years.

Countries around the world are entering a recession deliberately induced by central banks in response to the inflation crisis, and this will mean budget deficits. Furthermore, Reserve Bank Governor Adrian Orr has urged the government to either raise taxes or cut spending to aid in their efforts to contract the economy and thus reduce inflationary pressures. Unless the Labour leadership shows a sudden willingness to defy neoliberal orthodoxy and the dictates of the Reserve Bank, they will follow this advice.

If the recession starts to bite, the government will have to either tax the rich or implement austerity — and in doing so, attack their own supporters. Hipkins has preemptively chosen the latter option. Not only will transformational change be off the table; budgets for housing, healthcare, education, welfare and transport will be in the firing line of a Labour government led by the supposed party of working people. Ordinary people will suffer, inequality will get worse, and the progress Ardern made on poverty reduction will be reversed, all because of Hipkins’ “captain’s call.” But why?

Appeasing the rich

By ruling out a wealth or capital gains tax, Chris Hipkins is going against the wishes of the majority of voters, alienating his prospective coalition partners, angering members of his party, disappointing even his own ministers, taking off the table the prospect of any real change if his government is reelected, and potentially preparing the way for austerity. There is only one explanation for this move which makes sense: he is making a desperate, fawnish attempt to appease the wealthy few.

We are taught in this country that we live in a free and fair democracy where one person gets one vote. This is technically true. But the reality is that the rich have a hugely disproportionate sway in elections. Under capitalism, wealth is power. That is the phenomenon on display here.

Money has been gushing into the coffers of National and ACT in the run-up to the 2023 general election. National received a record $5.1 million in donations last year, while ACT raised more money than Labour despite the latter being the governing party and the former being a minor party. The war chests of the right-wing parties will only be growing heavier still now that we are mere months out from polling day.

The message is clear: National and ACT will form a government of the rich, by the rich, for the rich. The rich can simply afford to outspend ordinary workers when it comes to politics, and everything else.

Even more powerful than their ability to give mountains of donations is the fact that the majority of the media is owned by the rich. Newspapers, radio stations, television and now online news are, with few exceptions, controlled by millionaires and billionaires who do not want their taxes to go up, even if it benefits the rest of society immensely. They want a National-ACT government of the rich first and foremost; but if Labour win reelection, they want a compliant, moderate government that will refuse to make any major changes to society. The media coverage of corporate-owned outlets reflects this directly — any leader or party who represents a genuine threat to the wealth and power of the top 1% will come under immense fire.

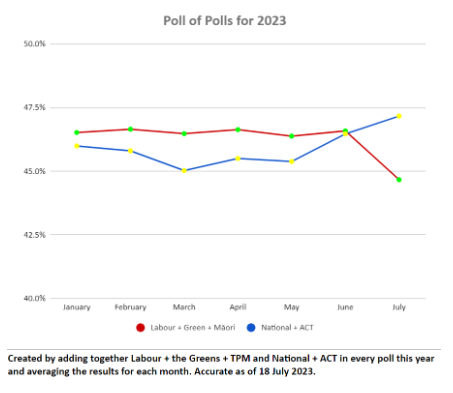

After a brief honeymoon at the beginning of the year when Hipkins replaced Ardern, Labour is sliding in the polls again, with National and ACT taking back a small lead over the left bloc. Time is running out and Hipkins is trying to stop the bleeding. He wants donations to roll back into his party and he wants more favourable media coverage. His refusal to tax the rich is not designed to appeal to the median voter, to his party membership or to the minor parties whose support he needs to have any hope of staying in office come October. It is a transparent attempt to announce to the wealthy few that he is not a threat to them and that they should allow him to stay as prime minister.

The tragedy of Hipkins’ position is that, whatever he does to appease the rich, they will always prefer a National-ACT Government to even the mildest Labour government. Generally speaking — again, with a few exceptions that prove the rule — the owners of big business want to pay even less tax than they already do; they want an end to Fair Pay Agreements that strengthen workers’ rights; and they want fewer increases to benefits and the minimum wage.

Yet Hipkins and his ilk will continue watering down their policies and abandoning their own supporters in a wretched attempt to win reelection, no matter the cost. Not because it’s popular, but because the rich simply hold more sway than the working class majority of society — one person, one vote be damned.

We are many, they are few

The crucial thing about the wealthy few is that they are just that — the few. They may have vast piles of cash to throw at their preferred parties; they may own the majority of the media; they may have huge power in society. But they are, in the end, outnumbered. The real power lies with the people, if the people organise and fight back.

The majority of Aotearoa is working class. The majority would benefit from higher taxes on the rich and lower taxes on low incomes. The majority would benefit from wealth redistribution; from affordable housing; from expanded and better funded public services; from climate action. The majority will suffer under austerity, no matter which party implements it.

We live in a wealthy society, and no one should live in poverty or without a home. No one should be struggling. The working class can fight back, force the rich to pay their fair share, and build a society in the interests of all. But it requires organisation, mobilisation and political leadership.

Right now, the Greens and Te Pāti Māori are showing leadership on this question. They are standing up to Hipkins and telling him that he cannot unilaterally decide that real change is off the table. They are threatening to sit on the cross benches if necessary, and rightly so. They must continue to make taxing the rich a major bottom line in their election campaigns and in any post-election negotiations.

In turn, every single person who wants to see a remotely progressive government in October should cast their party vote for the Greens or Te Pāti Māori. The era of Jacindamania, with Ardern’s constant talk of transformation, empathy and fairness, made the Labour Party look more progressive than it really was. Now under Hipkins’ leadership, Labour has well and truly exposed itself as a party committed to the broken status quo, with no courage or intention to change Aotearoa for the better. Voters should punish Labour for this by voting for the two parties in this election who want to tax the rich to improve the lives of ordinary people.

But voting left alone is not the answer. True change requires a mass movement of working class people demanding better. In the words of Frederick Douglass, a 19th century radical who campaigned for the abolition of slavery: “power concedes nothing without a demand. It never did and it never will.”

The trade unions founded the Labour Party. Some unions are still affiliated to Labour, while others are politically independent. Just as the Greens and Te Pāti Māori are doing, the union movement must draw a line in the sand with Labour this election — to earn the support of any union, Labour must tax the rich and take real action to benefit the working class.

Above all, to force the Labour leadership to reconsider taxing the rich, there needs to be a movement in the streets. Activists need to organise rallies in every city putting the demand out there: the dividing line this election is whether or not each party is going to tax the wealthy few. We need real change, and this is the only way it is going to happen. The pressure must be so high that Hipkins cannot maintain his position on this question.

Would the government really perform a u-turn on such a major policy announcement? They have done so before. One of the central policies on which Labour campaigned in its victorious 2017 election campaign was three years of fees-free university tuition. Yet it was none other than Hipkins who was education minister in 2020 when the government suddenly changed its mind and abandoned plans to make second and third year free. If Hipkins and Labour can u-turn on a popular policy so easily, then they can and they must be made to u-turn on their unpopular and untenable refusal to implement taxes on wealth or capital gains.

This is the key issue for the left in the 2023 general election campaign. It’s time for activists, whether from the Green Party, from Te Pāti Māori, from the trade unions or from community groups to organise and mobilise on this demand. A wealth tax should be the bottom line for every progressive force in society when it comes to supporting a Labour government in October.

The rich may have money and resources, but ordinary working people have the numbers. We are many, and they are few. Hipkins does not get to unilaterally rule out the prospect of the transformational change Aotearoa so desperately needs — it is simply not his decision to make. When a movement comes together to demand the rich pay their fair share, to demand real change, it will be too powerful to ignore.

System Change rally: Tax the Rich!

2pm, Saturday 19 August

Britomart, Auckland